What You Need to Know About Investment Banking

Investment banking provides many opportunities and rewards, yet understanding its economic foundation is crucial before considering this career option.

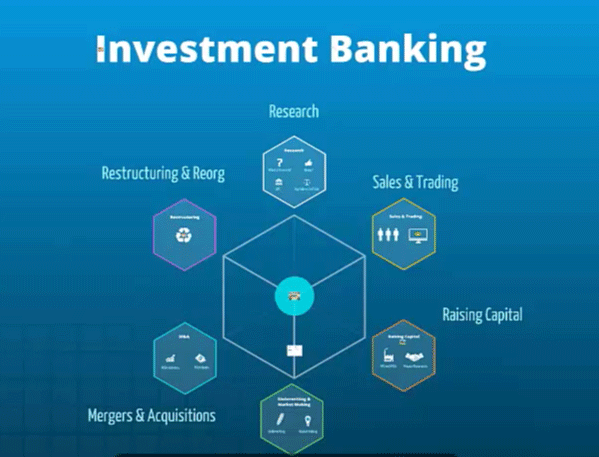

Investment banks primarily generate revenue through advisory fees, sales and trading fees and research activities. Research typically involves conducting analyses that help facilitate trading of stocks, bonds and other financial instruments.

Mergers & Acquisitions

Investment bankers provide governments and corporations with services for acquisitions and sales of business units, as well as advice to companies on a range of corporate finance issues such as raising capital, going public (i.e. selling shares on the stock exchange) or making investments that increase company profits.

Investment banks provide businesses in search of capital with access to investors looking for profitable returns from those funds. By buying securities from various entities and selling them on to investors, investment banks help keep financial markets active and efficient.

Some investment banks specialize in specific industry sectors and regions while boutique banks specialize in more specialized services. The largest investment banks known as bulge bracket are Goldman Sachs, JPMorgan Chase, Morgan Stanley and Bank of America Merrill Lynch – global household names all. Until 1999 when investment banking was legally separated from commercial banking via the Glass-Steagall Act.

Capital Raising

Investment banks provide essential financial expertise in raising capital through issuing securities to individuals, corporations and government entities. Furthermore, investment banks assist with mergers, acquisitions and prepare new companies for an initial public offering (IPO).

Underwriting is a core service provided by investment banks to this sector, as investment banks purchase instruments with monetary value before selling them on to investors. To do this effectively, banks must conduct in-depth due diligence on each issuance to ensure it complies with government regulations and provides an accurate valuation of its offering.

Firms often provide opportunities for income streams to become “securitized” through pooling assets such as mortgages and credit card receivables into fixed-income products for investors to buy as fixed income products. This requires conducting comprehensive risk analysis as well as engaging other brokers in order to distribute risk more evenly among brokers – key functions in keeping regulators and high net-worth individuals satisfied with business operations. Investment banking divisions usually comprise industry coverage groups as well as product coverage groups.

Equity Financing

People often associate investment banking with companies raising billions through initial public offerings (IPOs). Although this aspect of its work is certainly important, investment banks offer much more.

Investment banks provide many services to assist private companies in becoming publicly listed on stock exchanges, allowing both individuals and institutions to buy and sell shares easily. This process involves internal preparations as well as external marketing materials targeted towards research analysts and investors.

Equity Capital Markets (ECM) groups combine elements of both investment banking and sales and trading by helping companies raise equity capital. ECM teams focus on raising equity capital via initial public offerings (IPOs) or follow-on offerings; offering advice about convertible bonds or equity-linked securities that convert from debt into shares over time; as well as working alongside other investment banks in order to complete deals efficiently.

Market Making

When prices appear on CNBC or in the newspaper after being settled with an investment bank and its client, that represents an agreement at a particular time and price between both. While details vary between deals, typically they involve initial public offerings (IPO) of debt or equity securities.

Trader in the Sales & Trading Group are responsible for connecting buyers and sellers of securities on the market (known as a “market”), earning a modest commission known as bid-ask spread for providing both purchase and sale prices for purchase/sale transactions. Market makers assist in maintaining smooth markets by eliminating information asymmetries among investors.

Investment banks generate profits in several other ways. Underwriting loans (purchasing pools of assets and then selling off pieces to investors) and packaging and selling pools of corporate debt or equity securities (“securitization”) are two key sources. All these functions take place on the firm’s trading floor which typically employs traders with various service layers.