Using a Portfolio Investment to Achieve Your Goals

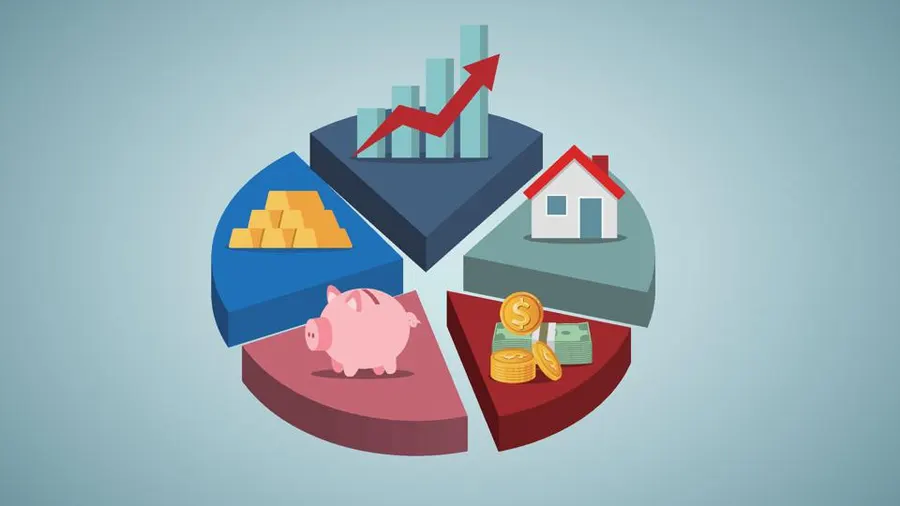

Financial portfolios enable investors to put their savings to work towards reaching their goals more quickly. A portfolio consists of an assortment of financial assets like stocks, bonds and cash that serve as investments.

Portfolio creation begins by understanding an investor’s risk tolerance and time horizon to select an asset allocation mix that best meets those requirements.

Aggressive

Aggressive portfolio investment strategies offer high potential returns but with greater risks than other investment vehicles, such as investing in small-cap stocks or high-yield debt instruments. Individuals who possess a high risk appetite and are willing to accept lower returns in exchange for greater potential rewards should consider this form of investing.

An aggressive investment strategy emphasizes capital appreciation, or significantly growing initial investments, typically adopted by younger investors with longer investment horizons in order to reduce short-term fluctuations within the market. This type of approach allows these investors to quickly recover from short-term market fluctuations.

Before making a decision on an aggressive investment strategy, it’s essential to assess both its risks and benefits. Consult a financial advisor who can provide tailored guidance that matches up with both your personal and financial goals – this makes retiring on your terms much simpler!

Speculative

Speculative portfolio investments represent high risks but may yield large gains, so this strategy is best suited for experienced investors with an understanding of its associated risks. It is wise to set aside money that you are comfortable losing before engaging in speculative investments – you may use investment screeners or newsletters to find promising opportunities.

A speculative portfolio targets companies that possess strong competitive advantages and the potential to become market monopolies, for instance an investor might purchase shares in a firm currently developing new products.

Speculative investments can be highly volatile due to being directly tied to world events. Conflict in the Middle East could cause oil prices to surge or dive; local and global economic trends also impact markets significantly; this combination makes speculative investments difficult for most investors to manage effectively.

Value

Value portfolios seek out stocks that are trading below their true worth, typically by assessing factors like price to book ratio, forward price earnings ratio or enterprise value to cash flow from operations ratio. This strategy often works well alongside fundamental and technical analysis in identifying undervalued stocks.

Value investments require ongoing evaluation as circumstances can alter and companies lose their value characteristics over time. Therefore, it’s essential that you regularly rebalance your portfolio so as not to become overexposed to one sector or stock.

Registered investment companies (funds) generally must use market values (or fair values determined in good faith by their boards of directors) when available market quotations are readily available to value their portfolio securities and assets. Staff guidance also addresses a fund’s responsibility in valuing its portfolio securities when the exchange or market in which they trade has closed without readily available market prices being available to use as benchmarks for valuation.

Income

Income-generating assets may be an ideal investment choice for investors seeking regular payments from their investments, including dividend-paying stocks, interest-bearing bonds and real estate investments. Such strategies can especially beneficial to retirees who require financial support in meeting living expenses from their investments.

Value portfolios invest in assets trading below their true valuation, providing an effective strategy to take advantage of market disruption and generate long-term profits.

Investors should select a portfolio that suits both their financial goals and risk tolerance capacity. ET Money Portfolio Health Checkup makes this easy with easy customisation based on market conditions, while helping monitor and rebalance portfolios to achieve desired outcomes. However, diversifying investments to minimise risks is always advised.