The Financial Ecosystem of Decentralized Autonomous Organizations (DAOs)

Imagine a company with no CEO, no central office, and no traditional hierarchy. Its bank account? It’s a digital treasury that requires group consensus for every transaction. Its shareholders? They’re global token holders voting on everything from software upgrades to multi-million dollar investments. Welcome to the financial ecosystem of a DAO—a world where money, code, and community collide.

It’s a bit messy, honestly. Wildly innovative, sure, but also complex. Let’s dive into how these entities actually manage their money, fund projects, and—you know—try to stay solvent without a CFO calling the shots.

The Treasury: More Than Just a Digital Piggy Bank

At the heart of every DAO’s financial structure is its treasury. Think of it less as a vault and more as the organization’s central economic engine. It’s typically a multi-signature wallet or a smart contract, holding the collective assets—usually a mix of native tokens, stablecoins like USDC, and maybe even some blue-chip cryptocurrencies (think Ethereum or Bitcoin).

Here’s the deal: no single person has the keys. Proposals to spend from it are voted on by token holders. That means paying a developer, funding a grant, or even buying a digital asset becomes a public, democratic process. It’s transparent, which is great, but it can also be… slow. And contentious.

Where Does the Money Come From? DAO Funding Models

DAOs aren’t magic. They need capital to operate. Their financial kickstart usually comes from a few key avenues:

- Token Sales: The most common launchpad. The DAO creates and sells a token, raising funds directly into the treasury. Buyers aren’t just investing; they’re buying voting rights and a stake in the network’s future.

- Protocol Fees: For DeFi DAOs (like those running lending platforms or exchanges), a small fee from every transaction is automatically routed back to the treasury. It’s a beautiful, self-sustaining revenue loop—if the protocol gets usage.

- NFT Sales: Community-focused DAOs often launch NFT collections. The mint proceeds go straight to the treasury, funding operations while the NFTs themselves act as membership passes.

- Grants & Donations: Some, especially in the public goods space, start with grants from larger crypto ecosystems or philanthropic contributions from aligned individuals.

Spending & Governance: The Art of Consensus-Based Finance

This is where things get really interesting. How do you spend money when hundreds or thousands of people have a say? The entire DAO financial management process hinges on proposal systems.

A member drafts a proposal: “Pay Contributor X 50,000 USDC for front-end development work over Q3.” That proposal goes to a forum for discussion—often heated. Then, it moves to a formal, on-chain vote. Token holders cast their votes, usually weighted by how many tokens they hold. If it passes, the treasury smart contract executes the payment automatically.

It’s governance, but for payroll. And marketing budgets. And software subscriptions. The friction is real, but so is the collective ownership it fosters.

The Tools That Make It All Tick

You can’t run this ecosystem on a spreadsheet. A suite of specialized tools has emerged:

| Tool Category | Purpose | Examples |

| Governance Platforms | Host forums & manage voting | Snapshot, Tally, Discourse |

| Treasury Management | Track assets, budget, payouts | Llama, Parcel, Multis |

| Payroll & Streaming | Automate contributor payments | Sablier, Superfluid, Utopia |

| Analytics | Monitor treasury health & metrics | DeepDAO, Dune Analytics |

Yield, Risk, and the Quest for Sustainability

A giant pile of crypto sitting idle? That’s a missed opportunity—and a risk due to volatility. So, many DAO treasuries have evolved into active, yield-seeking entities. This is a huge part of modern decentralized organization finance.

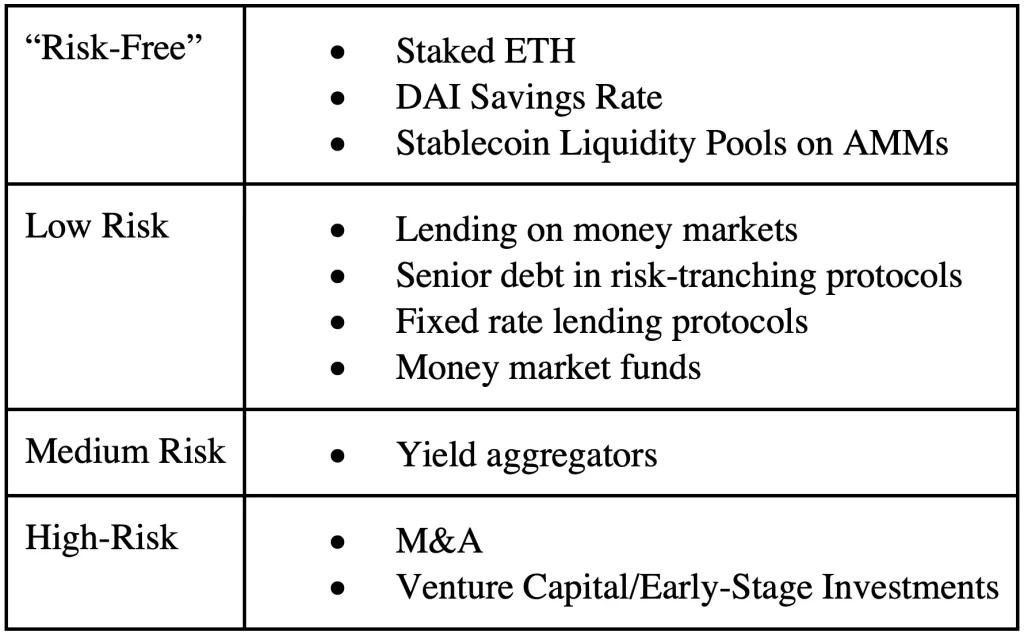

Treasury working groups might vote to deploy a portion of funds into DeFi strategies: providing liquidity for fees, staking for rewards, or making conservative loans through trusted protocols. The goal is to generate yield to fund operations indefinitely, moving toward a sustainable financial model that isn’t just reliant on token price appreciation.

But with yield comes risk. Smart contract vulnerabilities, market crashes, and governance attacks are constant threats. Diversification isn’t just a good idea; it’s a survival tactic.

The Human Hurdles: Compensation & Incentives

How do you pay people in a system designed to be leaderless? Contributor compensation is one of the trickiest, most human puzzles to solve. There’s rarely a standard salary. Instead, you see a patchwork of bounties (fixed prices for specific tasks), vested token grants, and stablecoin streams for ongoing work.

The incentive alignment is delicate. Pay too much in stablecoins, and contributors might not care about the token’s long-term health. Pay only in volatile native tokens, and people can’t pay their rent. Getting this balance right—mixing short-term needs with long-term alignment—is what separates thriving DAOs from those that slowly bleed talent.

Looking Ahead: The Uncharted Territory

The financial ecosystem of DAOs is being built in real-time. We’re seeing experiments with on-chain credit ratings for DAOs, legal wrappers that allow them to interact with traditional finance, and even sub-DAOs that manage specific financial verticals like investments or grants.

The core tension—between decentralized ideals and operational efficiency—won’t disappear. But that’s the fascinating part. This isn’t just a new way to hold money; it’s a radical reinvention of how collective economic action can be coordinated across the globe. No permission needed.

It’s clunky, imperfect, and breathtakingly ambitious. And honestly, that’s probably exactly how a truly new financial ecosystem should feel in its infancy. The ledger is open. The votes are being cast. The experiment, with all its capital and chaos, is very much alive.