The Role of Central Bank Digital Currencies (CBDCs) in Reshaping Cross-Border Forex Markets

Let’s be honest: the world of cross-border payments can feel a bit… archaic. It’s a tangled web of correspondent banks, layered fees, and delays that can stretch for days. The foreign exchange (forex) market, that colossal $7.5 trillion-a-day beast, operates on top of this creaky infrastructure. But a new player is quietly stepping onto the stage, promising not just an upgrade but a full-scale renovation. That player is the Central Bank Digital Currency, or CBDC.

Here’s the deal. CBDCs are digital versions of a nation’s fiat currency, issued and backed directly by the central bank. They’re not crypto in the wild-west sense, but they borrow some of the underlying tech. And their potential to reshape how money moves across borders—and thus, the very mechanics of forex trading—is, frankly, enormous.

The Current Forex Landscape: A World of Friction

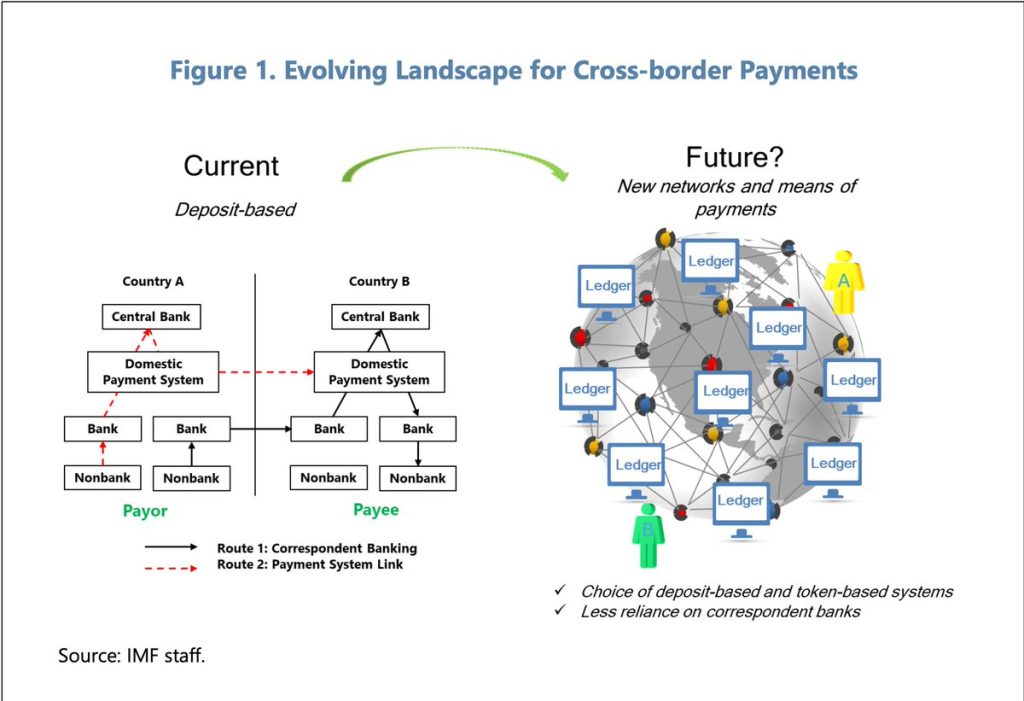

To see why CBDCs matter, you have to understand the current pain points. Today’s cross-border forex transaction is a relay race with too many runners. A business in Canada paying a supplier in Singapore involves multiple banks in different time zones, each with their own ledger systems and compliance checks.

This process creates three big headaches:

- Cost: Fees get stacked like pancakes—transaction fees, correspondent bank fees, FX conversion spreads.

- Speed: “Next-day” settlement is a best-case scenario; often it’s longer. Your money is in transit, earning no one any interest.

- Opacity: Ever tried tracking a payment across borders? It’s like following a ghost. You’re never quite sure where it is or what the final received amount will be.

This friction is the grease in the gears of the global forex market. And CBDCs are poised to be the ultimate degreaser.

How CBDCs Could Rewire the System

Imagine, for a second, a direct pipeline between central banks. That’s the core promise of CBDCs for cross-border use. By using digital currencies on shared platforms or through interoperability protocols, a dollar-CBDC could be exchanged for a euro-CBDC almost instantly, 24/7.

The Technical Leap: From Messaging to Programmable Money

Current systems like SWIFT are essentially messaging networks—they tell banks to debit and credit accounts. CBDCs are the assets themselves. This shift is fundamental. It allows for what’s called “atomic settlement”.

Think of it like a digital vending machine. You put in a digital yen, and the machine simultaneously releases a digital Australian dollar. The payment and the currency exchange are one single, irreversible event. No waiting for confirmations down the chain. This could compress settlement risk—a huge deal in forex—from days to seconds.

Implications for Market Structure & Participants

This isn’t just a back-office upgrade. It will ripple out to everyone.

| Market Participant | Potential Impact of CBDCs |

| Banks & Corridors | Reduced role as intermediaries for simple FX transactions. Revenue from fees and float could decline, pushing them toward value-added services. |

| Forex Traders | Near-instant settlement enables new, high-frequency strategies. Tighter spreads due to reduced friction and lower costs. |

| Businesses (Importers/Exporters) | Dramatically lower transaction costs, real-time treasury management, and crystal-clear payment tracking. |

| Central Banks | Unprecedented visibility into capital flows. Enhanced ability to implement monetary policy and enforce sanctions. |

Sure, this sounds utopian. And it’s not without its hurdles—which we’ll get to. But the direction of travel is clear: toward a faster, cheaper, more transparent system.

The Thorny Issues: It’s Not All Smooth Sailing

Okay, let’s pump the brakes for a second. This reshaping won’t happen overnight, and the path is littered with challenges. First, there’s the interoperability puzzle. A digital US dollar needs to seamlessly “talk to” a digital Chinese yuan. That requires unprecedented international cooperation on technical standards, legal frameworks, and governance. Projects like the BIS’s mBridge are testing this, but it’s complex, you know?

Then there’s the geopolitical dimension. Cross-border CBDC flows could bypass traditional financial channels, altering the global balance of monetary power. Will the dominance of the US dollar in forex be challenged? Possibly. Digital currency blocs could form, reshaping trade alliances.

And we can’t ignore privacy. Central banks would, in theory, have a direct window into every cross-border transaction. Finding the balance between combating illicit flows and preserving legitimate financial privacy is a massive, unsolved equation.

A Glimpse at the Future Forex Market

So, what might a CBDC-infused forex market actually look like in, say, a decade? Picture a hybrid ecosystem. Traditional forex for large, complex OTC derivatives will still exist—it’s not going extinct. But for a huge chunk of spot and forward transactions, especially in trade finance, the action will move to new platforms.

We might see the rise of 24/7 automated FX markets, where algorithms trade digital currency pairs directly on central bank platforms or licensed private venues. The concept of a “trading day” tied to a financial hub’s hours could blur. Liquidity could become more fragmented initially, but also more accessible.

Honestly, the most profound change might be the most subtle: the democratization of access. Smaller firms in emerging economies, currently priced out by high fees, could participate in global trade with far fewer financial barriers. That’s a reshaping that goes beyond markets and touches economies.

Final Thought: An Evolution, Not a Revolution

Look, CBDCs won’t vaporize the forex market tomorrow. This is a slow-burn evolution, tangled in policy wires and technical specs. The transition will be messy, contested, and uneven.

But the trajectory is set. The relentless pressure for efficiency, speed, and inclusion in global finance is pushing us toward digital-native solutions. CBDCs, for all their complexities, represent the most credible path forward for sovereign money in a digital age.

They’re not just a new type of currency; they’re a new type of financial infrastructure. And as that infrastructure gets laid, the cross-border forex market—that great, pulsing heart of global capitalism—will inevitably beat to a different, and very likely faster, rhythm.