Forex Trading During Global Economic Recessions and Recoveries

Let’s be honest—forex trading is never easy, but throw in a global recession or a shaky recovery, and things get… interesting. Currencies swing like pendulums, central banks scramble, and traders either panic or see opportunity. Here’s the deal: economic downturns and rebounds reshape the forex market in ways that can make or break your strategy.

How Recessions Shake Up Forex Markets

When economies shrink, currencies don’t just react—they overreact. Fear drives volatility, and suddenly, every GDP report or unemployment figure feels like a ticking bomb. But here’s the twist: not all currencies suffer equally.

Take the US dollar, for example. It’s often seen as a “safe haven” during crises. Investors flock to it, pushing its value up even while the US economy stumbles. Meanwhile, currencies tied to commodities (think AUD or CAD) might tank if demand for oil or metals drops.

Key Patterns in Recession Forex Trading

- Flight to safety: JPY, USD, and CHF tend to strengthen as investors seek stability.

- Commodity dips: Export-driven currencies (AUD, NOK) often weaken with global demand.

- Central bank chaos: Rate cuts or emergency policies can cause wild swings.

That said, recessions aren’t monolithic. The 2008 crisis played out differently than, say, the COVID-19 market crash. Context matters—a lot.

Trading Forex During Economic Recoveries

Recoveries are trickier than they seem. Sure, optimism returns, but currencies don’t just “snap back.” They lurch, stall, and sometimes fake you out entirely. Here’s what to watch:

Signs of a Real Recovery (Not a False Dawn)

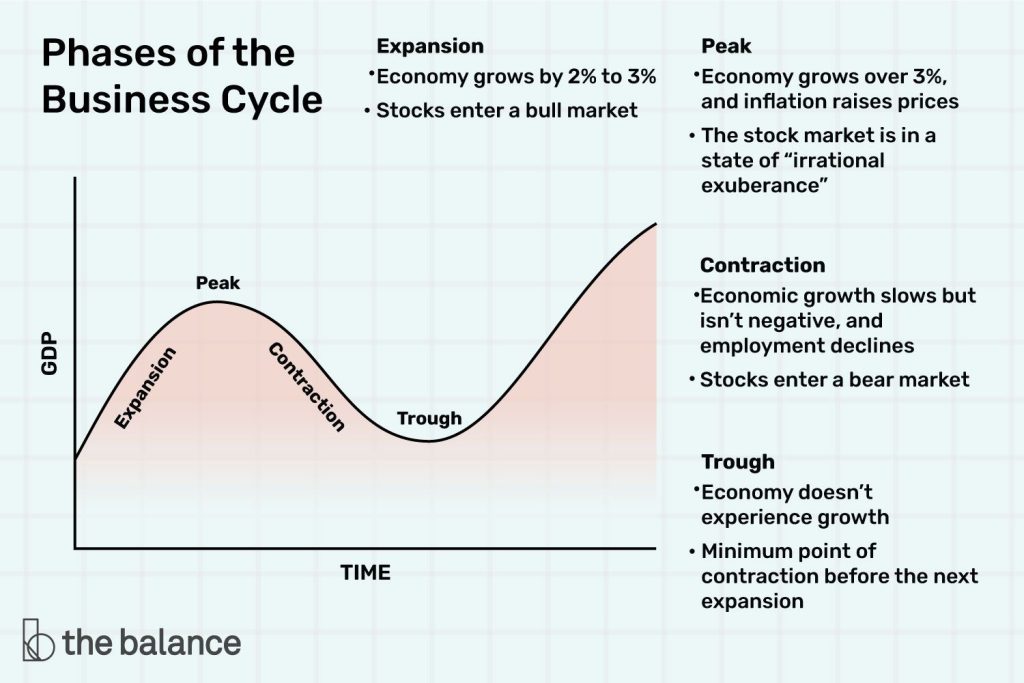

- Sustained GDP growth: One positive quarter isn’t enough—look for trends.

- Employment rebounds: Jobs = consumer spending = stronger currency.

- Central bank tone: Are they hinting at rate hikes? That’s a big clue.

And remember, recoveries aren’t linear. A country might bounce back faster than its trading partners, creating imbalances. The eurozone’s uneven recovery post-2008 is a classic example.

Strategies for Forex Traders in Turbulent Times

Okay, so how do you actually trade this mess? Here’s the thing—you need flexibility. What worked last year might flop tomorrow.

1. Hedge Like Your Portfolio Depends on It (Because It Does)

Diversify across safe havens and riskier plays. Maybe go long on USD/JPY but keep an eye on emerging markets for rebounds. And—this is crucial—use stop-losses. Volatility can wipe you out fast.

2. Follow the Money (Literally)

Capital flows shift dramatically during recessions. Watch bond yields, stock markets, and even crypto trends. Money rushing into US Treasuries? That’ll boost the dollar. Simple as that.

3. Trade the News, Not the Hype

Headlines scream doom, but data tells the real story. Focus on hard numbers—inflation reports, manufacturing indexes, retail sales. Ignore the noise.

The Psychological Game: Staying Sane When Markets Aren’t

Here’s the unsexy truth: your biggest enemy during recessions isn’t the market—it’s your own brain. Fear and greed amplify, and discipline crumbles. A few survival tips:

- Stick to your plan: No, really. Even when everything’s screaming at you to panic.

- Limit leverage: High leverage + high volatility = a recipe for margin calls.

- Take breaks: Obsessing over charts 24/7 leads to burnout (and bad trades).

Final Thought: Recessions End. Will Your Strategy Survive?

Markets cycle—always have, always will. The traders who thrive aren’t the ones predicting every twist, but those who adapt. So ask yourself: Is your approach built for the long haul, or just the latest crisis?